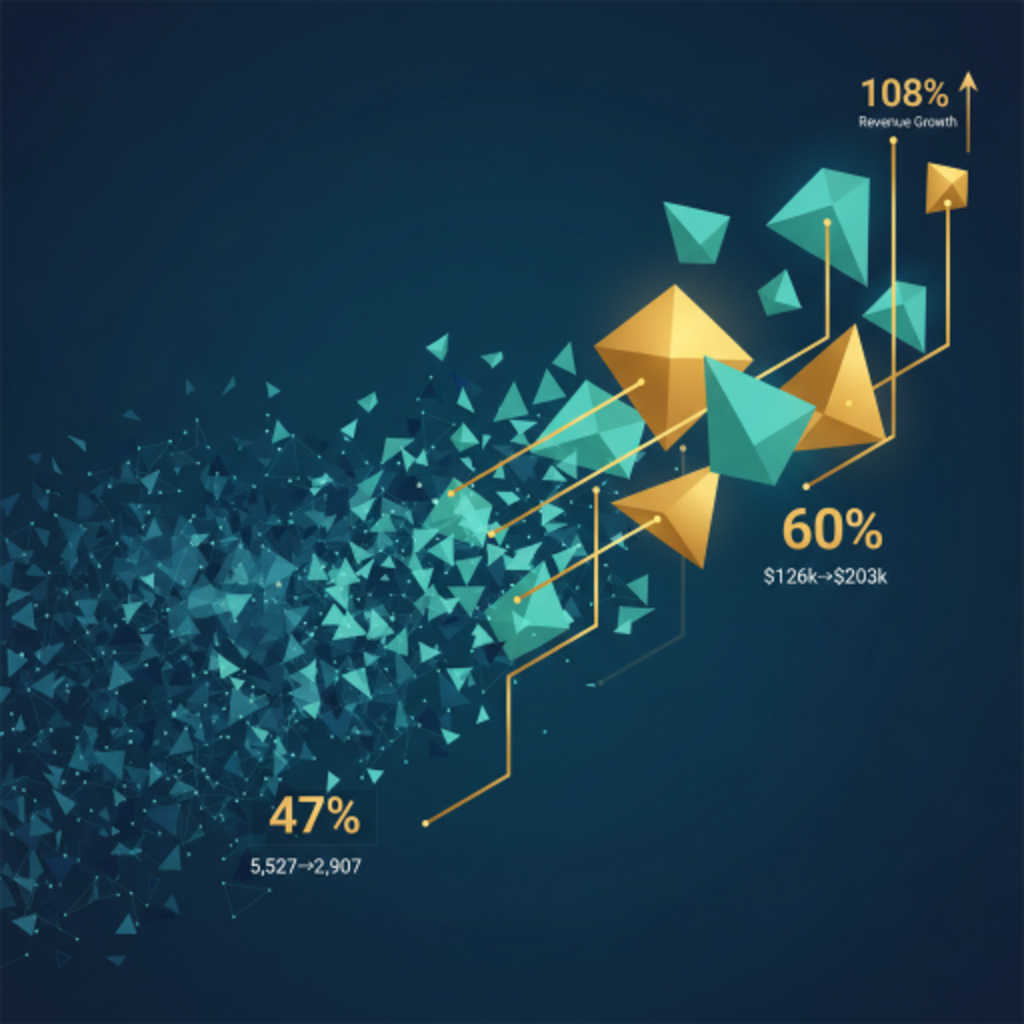

TL;DR: Klarna has reduced its workforce from 5,527 to 2,907 employees (47% reduction) since 2022 through AI adoption and natural attrition, whilst increasing average compensation by 60% from $126,000 to $203,000. Technology now performs work equivalent to 853 full-time staff, up from 700 earlier this year. The company achieved 108% revenue growth with flat operating costs, reaching $1.1m revenue per employee.

Buy now, pay later company Klarna has demonstrated how aggressive AI adoption can simultaneously reduce headcount and increase employee compensation, with CEO Sebastian Siemiatkowski revealing the company hasn’t hired new staff “for a few years.”

The workforce reduction occurred primarily through natural attrition, with departing staff replaced by technology rather than new employees. AI systems now carry out work equivalent to 853 full-time staff, particularly in customer service roles previously handled by outsourced workers.

“We have managed to increase revenues by 108% whilst keeping operating costs flat,” Siemiatkowski told analysts on an earnings call. “That’s pretty remarkable, and unheard of as a number, among businesses.”

Shared Efficiency Gains Model

Klarna has implemented a deliberate strategy to share AI-driven efficiency gains with remaining employees. Average compensation—including employee-related taxes and pension contributions—has jumped from $126,000 in 2022 to $203,000 today.

“We have made a commitment to our employees that all of these efficiency gains, and especially the applications of AI, should also, to some degree, come back in their pay cheques so that they are fully incentivised [and] aligned with the investors, to drive these changes through the company,” explained Siemiatkowski.

The CEO, who holds shareholdings in AI firms including OpenAI and Perplexity through his family investment firm Flat Capital, indicated further workforce reductions may be ahead. He expressed hope to continue increasing revenue per employee—currently at $1.1m—suggesting the metric will rise through further automation rather than expansion.

Financial Performance and AI Infrastructure Views

Klarna reported 26% revenue growth in Q3 2025, reaching $903m and beating analyst expectations of $882m. However, the Swedish company posted a $95m loss for the period, significantly higher than the $4m loss in the previous year—primarily driven by US accounting standard changes following its September New York stock exchange listing.

Siemiatkowski cautioned against costly datacenter investments for AI, telling the Financial Times he expects the technology will become more efficient over time. The stance contrasts with hyperscaler approaches but aligns with Klarna’s operational efficiency focus.

Workforce Transformation Implications

The Klarna model presents a distinctive approach to AI workforce transformation: aggressive automation combined with significant compensation increases for remaining staff. The strategy has enabled the Swedish fintech to maintain service levels whilst reducing headcount by nearly half.

Key metrics illustrate the transformation’s scale:

- 47% workforce reduction (5,527 to 2,907 employees)

- 60% increase in average compensation ($126k to $203k)

- 108% revenue growth with flat operating costs

- AI equivalent to 853 full-time staff (up from 700)

- $1.1m revenue per employee

The approach raises questions about sustainability and broader labour market implications, particularly as Siemiatkowski signals continued focus on increasing revenue per employee through further automation. For SMEs considering AI adoption, Klarna’s model demonstrates both the potential for dramatic efficiency gains and the strategic importance of managing workforce transitions.

Source: The Guardian