TL;DR

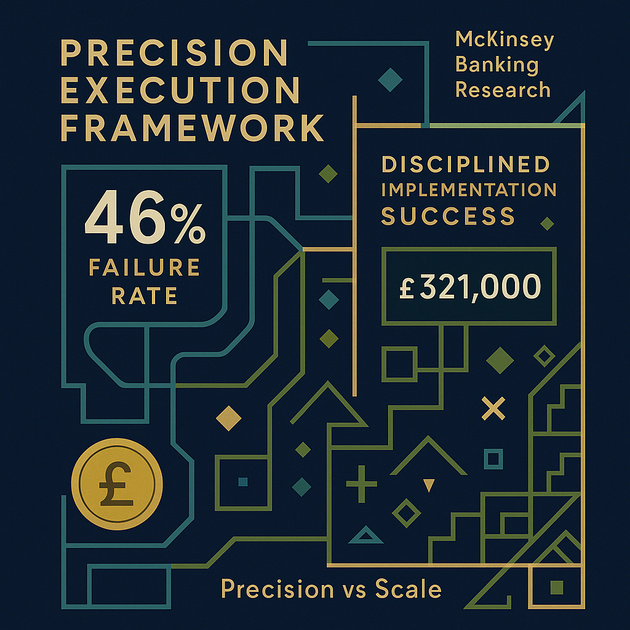

Resultsense analysis of 2024-2025 UK SME AI adoption data reveals a precision execution crisis: whilst 31% of UK businesses now use AI, 46% of proofs-of-concept fail to scale, and 36–42% of projects are abandoned entirely. The average implementation costs £321,000, yet 44% deliver only “minor gains.” Banking sector evidence from McKinsey’s 2025 Global Banking Annual Review exposes why: organisations pursuing “scale-first” or “AI everywhere” approaches face profit pool erosion and value destruction, whilst those executing precision-led strategies—solving tightly defined problems with measurable outcomes—capture sustainable competitive advantages worth millions annually.

UK reality check: British SMEs spent £1.8 billion on AI in 2024, with individual implementations averaging £321,000. Yet 70% routinely exceed budgets by 20–70%, and many abandon projects due to poor problem definition, data unreadiness, and enterprise-mimicking approaches unsuited to SME resource constraints. The evidence shows precision beats comprehensiveness—but only when execution discipline addresses UK-specific challenges including fragmented tools, siloed data, expertise gaps (35% cite lack of skills), and stringent privacy requirements.

The UK AI adoption paradox: High spend, low impact

Resultsense’s synthesis of 2024-2025 research data reveals a troubling pattern across UK SME AI adoption:

Adoption is accelerating:

- 31% of UK SMEs actively use AI (YouGov, August 2025; British Chambers of Commerce/Intuit, September 2025)

- Another 15% plan to adopt within 12 months

- IT/telecoms (56%) and marketing (53%) sectors lead; manufacturing (19%) and retail (19%) lag significantly

- Total SME AI investment reached £1.8 billion in 2024

But value realisation remains elusive:

- 36–42% of UK SME AI projects are abandoned (S&P Global, OneAdvanced)

- 46% of proofs-of-concept never reach production

- 80% of healthcare sector pilots fail to scale (HealthTechDigital)

- Average implementation cost: £321,000 per business (Storyblok survey, April 2025)

- 44% report only “slight” business gains despite significant investment

- 70% routinely exceed initial budgets by 20–70% (gigCMO, multiple industry sources)

Resultsense finding: The disconnect between adoption rates and value delivery mirrors patterns we observe across UK professional services and regulated sectors. The root cause isn’t technology maturity—it’s execution discipline. Organisations copying “enterprise AI” playbooks or chasing trendy use cases without strategic alignment waste six-figure sums on initiatives that deliver marginal improvements to business fundamentals.

UK-specific barriers driving failure rates

UK SMEs face distinct challenges compared to US or EU counterparts:

Skills and expertise shortage (35% cite as primary barrier):

- Only 27% actively recruit GenAI specialists (down from 37% in 2024)

- Most pivot to internal upskilling due to cost and talent scarcity

- Technical expertise gap particularly acute in manufacturing, retail, and traditional professional services

Data readiness crisis:

- Fragmented toolsets and siloed data across legacy UK business systems (Sage, Xero, QuickBooks)

- Poor data quality and inconsistent governance a leading cause of failure

- Integration costs (50–70% of total project spend) systematically underestimated

Cultural and regulatory hesitation:

- 45% cite “technology adoption” as biggest barrier (Employment Hero Work That Works report)

- Stringent privacy concerns and UK GDPR compliance requirements create higher implementation friction than US

- 39% of UK public view AI as risk vs 20% as opportunity—limiting organisational willingness to pursue “bold” transformation

Resource constraints:

- Micro-SMEs (1–9 employees): 42% report “no plans” for AI

- Actual deep adoption (“fully embedding” AI in core workflows) only 11% across all SME segments

- Realistic budgeting for people, process, and technical integration occurs in fewer than 30% of implementations

Banking’s £170 billion lesson: Why precision execution matters more than budget

McKinsey’s 2025 Global Banking Annual Review provides a critical counterpoint to UK SME AI struggles—not because banking is directly analogous, but because it exposes the precision-versus-scale dynamic at industry level.

The banking sector paradox:

- Global banking generated $1.2 trillion in profits (2024) yet trades at 70% valuation discount versus other industries

- Agentic AI could reduce costs by $700–800 billion (15–20%)

- Yet competitive dynamics will compete away savings unless banks fundamentally reinvent business models

- Result: McKinsey projects $170 billion (9%) profit pool erosion by 2030 without strategic adaptation

The precision advantage:

- Pioneers capturing 15–20% productivity gains early could open four-point ROTE gap versus slow movers

- For a bank with £80 billion in assets, this translates to £200 million in additional annual profit

- Gap emerges not from technology deployment but from strategic execution discipline

Resultsense interpretation: Banking’s £170 billion erosion risk mirrors UK SME’s £321,000 implementation failures at different scale. Both stem from identical root cause: pursuing “AI transformation” as technology project rather than business strategy. The banking data demonstrates that efficiency gains alone don’t protect competitive position—precision execution creating defensible advantages does.

Three disruption mechanisms exposing execution gaps

McKinsey identifies three ways AI reshapes profit pools—each revealing why precision execution matters:

1. Customer behaviour optimisation (deposit migration)

Global banking holds $23 trillion in near-zero-rate checking accounts. If AI agents prompt just 5–10% to migrate to top-of-market rates, deposit profits could decline 20%+.

UK SME parallel: Procurement AI agents already optimise supplier relationships, cloud costs, and service provider selection. Professional service firms relying on client inertia rather than value delivery face disintermediation risk as AI reduces switching friction to near-zero.

Precision response: Identify which profit pools depend on inertia versus genuine value. Build switching costs through expertise integration, not contract lock-in.

2. Product commoditisation (credit arbitrage)

75% of US credit card balances come from prime borrowers paying above-market rates due to switching friction. McKinsey projects 30% profit decline if AI-enabled arbitrage reaches just 5–10% adoption.

UK SME parallel: AI agents comparing accounting software, CRM platforms, or business banking facilities expose where UK SMEs overpay for commoditised services wrapped in relationship pricing.

Precision response: Compete on measurable outcomes and demonstrable ROI, not relationship longevity or brand trust alone.

3. Intermediation layer (third-party agents)

Customers interacting with banks only through AI agents may not know which institution houses their deposits—weakening brand loyalty and relationship economics.

UK SME parallel: AI purchasing agents, automated procurement systems, and algorithmic vendor selection reduce long-term B2B relationships to transactional interactions optimised on price/performance alone.

Precision response: Build AI-native customer interfaces delivering superior outcomes through intelligent automation, not defending legacy processes.

The precision playbook: What successful UK SMEs do differently

Analysis of successful UK AI implementations—including NHS stroke care (treatment times reduced ~1 hour, recovery rates 16% to 48%), Sage Copilot (5 days saved per month-end), and Cambridge JBS case studies (27–133% productivity gains)—reveals consistent patterns:

Characteristic 1: Problem-first, not technology-first

Failed approach: “We need AI” → technology selection → problem fitting

- Retail SME implementing chatbots due to market pressure despite customer dislike

- Logistics firm spending £180,000 over 9 months with no value realised due to poor problem definition

Precision approach: Business outcome definition → capability requirements → technology selection

- Sage targeting month-end cycle pain points specifically

- NHS focusing on stroke treatment time reduction with measurable clinical outcomes

Resultsense principle: Technology selection follows problem definition, never precedes it. UK SMEs succeeding with AI invest 40–60% of project time in problem scoping, stakeholder alignment, and success metric definition before vendor evaluation begins.

Characteristic 2: Realistic resource budgeting

Typical UK SME spend requirements (gigCMO, Leanware UK data):

- Micro-business (1–10 staff): £2,000–£10,000 over 3–6 months

- Small business (10–50 employees): £15,000–£75,000 for 6–9 months

- Medium business (50–250 employees): £50,000–£250,000 first year

Hidden cost factors (often 50–70% of total spend):

- Data cleaning and migration

- Legacy system integration (Sage/Xero/QuickBooks API limitations)

- Staff training and change management (4–16 weeks ramp-up per team member)

- Ongoing maintenance and model drift management

Leadership time commitment:

- 2–4 hours weekly senior leadership engagement minimum

- Projects lacking visible C-level sponsorship show 3x higher failure rates

Resultsense finding: Only 30% of UK SMEs budget realistically for people, process, and technical integration. The remaining 70% underestimate integration costs by 40–100%, leading to mid-project scope cuts or outright abandonment.

Characteristic 3: Pilot-first with scale discipline

The J-curve reality:

- Productivity typically dips 3–6 months during implementation (“the J-curve”)

- Successful pilots deliver £3.70 for every pound invested (Google Cloud survey)

- But 46% of UK PoCs fail to progress to production

Scale readiness checklist:

- Data governance and quality standards operational (not aspirational)

- User adoption exceeds 60% in pilot population

- Measurable business outcomes achieved within 6–9 months

- Integration with core systems validated, not prototyped

- Change management process established with senior sponsorship

Common scaling failure patterns:

- NHS: 80% of healthcare pilots fail to scale due to legacy system constraints

- Enterprise mimicry: SMEs copying large organisation patterns without resource adaptation

- “Innovation lab” syndrome: Proof-of-concept treated as success metric rather than production readiness

Resultsense principle: Pilot success requires production pathway validation from day one. UK SMEs treating pilots as R&D experiments rather than production prototypes waste resources on insights that never scale. Precision execution means testing production constraints during pilot phase, not discovering them post-investment.

Characteristic 4: In-house oversight, selective outsourcing

Minimum viable AI team for UK SME:

- Project lead/business owner: Accountable for outcomes, not technology deployment

- Data/privacy expert: UK GDPR compliance, ICO requirements, data quality standards

- Process champion: Workflow redesign and change management leadership

- IT/systems integration: API connectivity, legacy system compatibility

- External consultancy: AI modelling, initial integration, change management best practice

In-house vs outsourced boundaries:

- Keep in-house: Business problem definition, data governance, outcome accountability, user adoption

- Outsource selectively: AI model development, complex integrations, specialist skills (NLP, computer vision)

- Avoid: Outsourcing strategic decisions to vendors with product-led incentives

Vendor selection criteria (beyond price and features):

- UK market experience with SME implementations (not enterprise case studies)

- Integration expertise with UK legacy systems (Sage, Xero, QuickBooks)

- Transparent total cost of ownership (licence + integration + training + maintenance)

- Data governance and UK GDPR compliance as baseline, not add-on

- Business outcome focus, not technology capability showcase

Five execution pitfalls destroying UK SME AI value

Our analysis of UK failure patterns reveals consistent execution errors:

Pitfall 1: No strategic roadmap

Error: Launching AI initiatives by copying competitor success stories or vendor case studies without strategic fit assessment.

UK evidence: Top failure driver cited across S&P Global, gigCMO, and practitioner research.

Correction: Map AI use cases to core value creation strategy before technology evaluation. Ask: “If this succeeds, will it materially impact competitive position or will competitors easily replicate?”

Pitfall 2: “Letting a thousand flowers bloom”

Error: Bottom-up identification of use cases in each function without coordinated strategy, leading to:

- Resource fragmentation across 5–10 micro-initiatives

- Pilots that never scale due to insufficient investment

- Technology sprawl creating new integration problems

UK evidence: 42% of projects fail due to misaligned incentives and pilot-only focus.

Correction: Limit active AI initiatives to 2–3 simultaneously. Concentrate resources on highest-impact opportunities with clear scale pathway.

Pitfall 3: Deployment focus, not value focus

Error: Measuring success by technology adoption rates rather than business outcomes.

UK evidence: 70% of companies use generative AI yet report no significant bottom-line impact; Microsoft 365 Copilot adoption high but measurable ROI low.

Correction: Define success metrics in business terms (cost per transaction, sales cycle length, customer satisfaction scores) not technology terms (user adoption %, API calls, model accuracy).

Resultsense observation: The UK’s 31% AI adoption rate masks underlying value delivery failure. Our client work consistently reveals organisations conflating “using AI” with “achieving outcomes through AI.” The former is technology deployment; the latter requires business transformation. Only the latter creates competitive advantage.

Pitfall 4: IT-led, not business-led

Error: Delegating AI strategy to technology functions without business leader accountability for outcomes.

UK evidence: Business/digital team communication breakdown cited as top-three failure cause across multiple UK studies.

Correction: Business leaders must drive use case selection, success criteria definition, and outcome accountability. IT delivers technology enablement, not business strategy.

Pitfall 5: Insufficient capacity creation

Error: Deploying AI without fundamental workflow redesign or comprehensive change management.

UK evidence: Staff upskilling gaps, expectation mismatches, and lack of leadership engagement drive 35–45% of UK project failures.

Correction: Budget 4–16 weeks per team member for training and workflow adaptation. Treat AI as business process transformation, not technology installation.

UK regulatory and competitive landscape: FCA stance and vendor dynamics

FCA maintains principles-based approach

Unlike the EU’s risk-tiered AI Act, the UK Financial Conduct Authority maintains “technology-neutral, principles-based, outcomes-focused” regulation (FCA AI Update, September 2025):

- No bespoke AI rules: Existing consumer protection, operational resilience, and data governance requirements apply

- Pragmatic enforcement: ICO guidance emphasises lawful basis, documentation, and anonymisation without prescriptive technical standards

- Divergence from EU: UK approach favours flexibility and innovation over rigid compliance frameworks

UK SME implication: Regulatory environment permits rapid AI experimentation but requires robust governance foundation. Treating “no specific AI rules” as “no AI governance needed” creates compliance and reputational risk.

UK AI consultancy and vendor landscape

Non-Big 4 UK consultancies (gigCMO, OpenKit, TheCodeV, Techcare) typically offer:

- Strategy: £3,000–£5,000 for problem scoping and roadmap development

- Pilots: £20,000–£60,000 for proof-of-concept with limited production integration

- Full builds: £60,000–£200,000+ for production-grade implementations

Pricing models:

- Hourly: £100–£300/hour (varies by expertise and firm size)

- Value-based: Percentage of realised ROI (risk-sharing)

- Project-based: Fixed scope deliverables

- Retainer: £2,000–£15,000/month for ongoing support

Common UK SME use cases delivering <12-month ROI:

- Automated CRM and customer service chat (Zoho CRM Zia, DataMind AI)

- Sales and lead generation (LeadGenius Pro, Microsoft Copilot)

- Content creation and marketing automation (ChatGPT, Canva AI)

- Accounting and financial close (Sage Copilot, Xero, QuickBooks, Vic.ai)

- Predictive analytics for demand forecasting

Strong UK SME vendor presence: OpenAI (ChatGPT), DataMind AI, LeadGenius Pro, Microsoft Copilot, Sage Copilot, Zoho, Canva, Xero, QuickBooks, Vic.ai, Botkeeper.

Counter-narratives: When traditional solutions outperform AI

Resultsense analysis includes critical counter-evidence challenging “AI solves everything” narratives:

Job displacement reality

- Projection: Up to 3 million UK jobs “at risk” over next decade (Tony Blair Institute)

- Nuance: Many offset by newly created roles; manual, routine, data-processing roles most exposed

- SME implication: AI deployment without workforce transition planning creates morale and productivity problems that offset efficiency gains

Public trust deficit

- UK sentiment: 39% view AI as risk, only 20% as opportunity (Institute for Global Change)

- Adoption constraint: Lack of public trust slows rollout and limits political support for bold initiatives

- Business implication: B2C AI applications require greater transparency and human oversight to maintain customer confidence

Traditional improvement opportunities

Critical finding: Many UK SMEs report simple workflow optimisation or better data management outperforms AI adoption in productivity and risk reduction at significantly lower cost.

Examples:

- Standardising data entry across departments delivers 20–30% efficiency gain without AI

- Process documentation and workflow mapping reveals 15–25% time waste eliminable through basic automation

- Better use of existing software features (Sage, Xero, CRM platforms) produces measurable ROI before AI investment needed

Resultsense principle: AI is solution to specific problems, not universal business improvement strategy. UK SMEs must honestly assess whether fundamental business practices, data hygiene, or process discipline improvements would deliver superior ROI at lower risk before pursuing AI transformation. Technology excellence cannot compensate for operational mediocrity.

Hidden costs and technical debt

Vendor ROI claims often exclude:

- Integration and API development: 30–50% of total cost

- Training and change management: 20–40% of total cost

- Ongoing maintenance and model drift management: 15–25% annual recurring cost

- Technical debt from rapid implementation: Compounds over 18–36 months, creating legacy constraints

UK-specific integration challenges:

- Sage/Xero/QuickBooks API limitations and data migration complexity

- Legacy system constraints in established businesses (particularly retail, manufacturing)

- Data quality issues requiring 6–12 months remediation before AI readiness

Resultsense strategic framework: Precision execution for UK SMEs

Based on synthesis of UK adoption data, banking sector evidence, and Resultsense client experience, we recommend this four-priority framework:

Priority 1: Assess AI’s structural impact on your industry

Strategic questions:

- How could AI agents optimise customer purchasing decisions in your sector?

- Which profit pools depend on customer inertia, information asymmetry, or switching costs AI could eliminate?

- What third-party AI intermediaries could disintermediate your customer relationships?

UK SME context: Professional services, B2B suppliers, and relationship-driven sectors face highest disintermediation risk. Product/service differentiation based on expertise and outcomes provides stronger defence than relationship longevity alone.

Priority 2: Identify 2–3 precision execution opportunities

Selection criteria:

- Tightly defined business problems with measurable current-state baselines

- Workflows where 15–20% improvement would materially impact competitive position

- Use cases where data quality and system integration constraints are manageable

- Opportunities where customer value justifies implementation cost

UK resource constraints:

- Micro/small businesses: Maximum 1–2 concurrent AI initiatives

- Medium businesses: Maximum 2–3 concurrent initiatives

- Avoid spreading £50,000–£250,000 budgets across 5+ micro-projects

Priority 3: Build foundational capabilities before scaling

Prerequisites for AI at scale:

- Data architecture: Clean, governed, accessible data supporting real-time decisioning

- Talent and skills: Prompt engineering, agentic workflow design, AI governance (build or partner)

- Operating model: Business leaders accountable for AI outcomes, not IT departments

- Governance framework: UK GDPR compliance, ICO requirements, model risk management

- Change management: 2–4 hours weekly leadership commitment, 4–16 weeks team ramp-up planning

UK-specific readiness:

- ICO data protection requirements as baseline, not afterthought

- Integration strategy for Sage/Xero/QuickBooks and sector-specific legacy systems

- Realistic assessment of in-house skills versus selective outsourcing needs

Priority 4: Design for competitive advantage, not just efficiency

Strategic positioning:

- Efficiency gains will be competed away unless reinvested into defensible competitive advantages

- Capture market share whilst competitors struggle with implementation failures

- Build AI-native customer experiences creating switching costs rather than reducing them

UK market dynamics:

- 31% active AI adoption means competitive parity requires execution excellence, not just deployment

- 46% PoC failure rate creates opportunity window for precision executors

- 3–5 year window before AI-native business models reset industry structure (McKinsey projection)

Resultsense positioning: Our AI Strategy Blueprint service addresses Priority 1–2 (industry impact assessment and precision opportunity identification). Our AI Integration service delivers Priority 3–4 (foundational capability building and competitive advantage design). We explicitly reject “AI everywhere” approaches in favour of measured, outcome-driven precision execution aligned to UK SME resource realities.

Conclusion: Precision execution as competitive differentiator

The UK SME AI adoption data reveals a critical inflection point: 31% active adoption signals technology maturity, yet 36–46% failure rates expose execution capability gap. The average £321,000 implementation cost delivers “only minor gains” for 44% of businesses—not because AI lacks potential, but because organisations pursue scale over precision.

Banking sector evidence from McKinsey reinforces this lesson at industry level: $700–800 billion in potential cost savings compete away without strategic reinvention, resulting in $170 billion profit pool erosion. The parallel to UK SME failures is exact: efficiency without competitive advantage creates no lasting value.

The precision execution advantage:

- Tightly defined problems with measurable outcomes

- Realistic resource budgeting including integration, training, and ongoing maintenance

- Pilot-first with production pathway validation from day one

- Business-led strategy with selective technology expertise

- In-house oversight of data, governance, and outcome accountability

UK SME-specific requirements:

- Honest assessment of whether traditional improvements outperform AI at lower risk

- UK GDPR and ICO compliance as foundation, not compliance afterthought

- Integration strategy for UK legacy systems (Sage, Xero, QuickBooks)

- Vendor selection prioritising UK SME experience over enterprise credentials

- Resource constraints demanding 2–3 maximum concurrent initiatives, not 10+ micro-projects

The choice facing UK business leaders mirrors banking’s strategic inflection point: invest strategically in precision-led AI capabilities creating defensible competitive advantages, or risk becoming the 46% whose proof-of-concept never reaches production—or the 42% who abandon implementations entirely after six-figure investments deliver only marginal improvements.

Precision execution separates AI transformation from expensive experimentation. The evidence shows that budget size matters far less than execution discipline, strategic alignment, and realistic assessment of foundational capability gaps.

The UK’s 31% adoption rate creates competitive imperative. The 46% failure rate creates competitive opportunity. Which category will your organisation occupy?

About this analysis: This strategic insights article synthesises UK SME AI adoption research from YouGov, British Chambers of Commerce, Intuit, S&P Global, gigCMO, Storyblok, and UK government sources (2024-2025 data), combined with McKinsey & Company’s 2025 Global Banking Annual Review for sector-level competitive dynamics illustration. Resultsense Limited provides original analysis interpreting multiple research streams through the lens of UK SME implementation realities, resource constraints, and precision execution requirements.

Research methodology: Analysis incorporates 15+ independent UK surveys (sample sizes 300–73,650), government reports, academic studies (Cambridge JBS, University of St Andrews), FCA regulatory guidance, and practitioner implementation case studies. Counter-narratives and failure analysis deliberately included to provide balanced perspective on AI adoption risks and traditional improvement alternatives.

Related services: Resultsense’s AI Strategy Blueprint helps UK SMEs develop precision-led AI roadmaps aligned to measurable business outcomes, avoiding the 46% proof-of-concept failure rate through rigorous problem definition and capability assessment. Our AI Integration service delivers the foundational capabilities—data architecture, governance frameworks, and operational discipline—that separate successful implementations from the 44% reporting “only minor gains” despite £321,000 average spend. Our AI Risk Management Service addresses UK GDPR compliance, ICO requirements, and model governance essential for regulated sector deployments.